Hello, welcome to TOD-AI, the market news with analysis and discussions to better understand what is really happening in the financial world.

All characters are not real.

Charting platform used for this analysis is provided by TradingView

MARKET SITUATION

We are at a time when stocks continue to have historically high valuations. After reaching highs at the end of 2021, they reversed the trend to drop to a low in October 2022, and then continue above that floor ever since.

The money supply has almost doubled in 7 years in the United States as in other economies, also being strengthened in the crisis of February 2020.

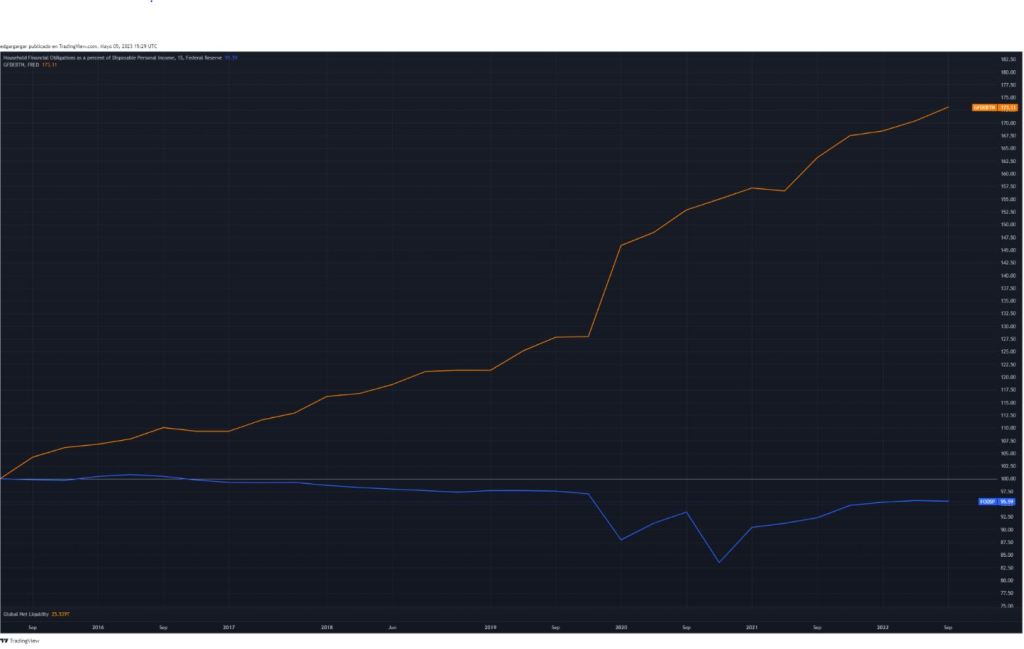

Liquidity has also been on the rise since the 2008 crisis due to central bank stimulus. They changed their policy to a restrictive one in March 2022 and reduced balance sheets until October 2022, at which time global liquidity also reached a minimum that has not been exceeded again.

The correlation between the markets and global liquidity is very high and it seems logical to ask how this liquidity is going to evolve to make bets on the market.

As for the most important indicators to follow in the financial world, the inflation rate is low compared to the one we had a year ago, but we are coming from very high rates of the previous year. If we look at the evolution of inflation for broader periods, we realize that we are at highs not seen in decades. To understand it, we look at the graph of evolution of annual inflation along with that of 5-year inflation. We believe that the 5-year-old in blue better reflects the real evolution of prices that continues to rise and allows us to observe that what we pay for things is becoming more and more and becomes 20% higher than 5 years before.

The GDP growth of the United States and the evolution of unemployment have been stable in recent months. The downward trend in retail sales, consumer savings and business results can generate a climate of recession in the medium term. If we understand Retail sales as an important indicator of economic activity, we see that the amount in volume grows, but if we weight it based on the money supply, we observe that proportionally to the existing money, Retail sales have not even recovered values prior to the 2020 break. This means that all the money that has been created in the economy by the central banks has not gone to consumption and has been parked in financial assets that have been revalued. It has kept afloat organizations and institutions that could not pay their debt.

Governments have to face a high debt whose payments are going to be seriously increased from the end of the year by the booms in interest rates. Getting into more debt is now more expensive for them and having to raise more through taxes is not easy if you enter a recession. This would lead to the need for central banks to expand liquidity again. Although the net debt of families has decreased slightly in the last five years, the public debt continues to grow and is expected to continue until at least 2053.

Public debt Versus Families

Central banks have been increasing interest rates over the past year at a strong pace except for China which already had higher interest rates and Japan. In the United States, they have risen by 5% in a year with the intention of stopping runaway inflation.

DISCUSSION

Next, our virtual characters CINDY NERO and MAX CARO are going to tell us about the market situation in depth. The philosophy of this program is that there is debate and different opinions and that it is the viewer who evaluates by his own criteria based on the pros and cons of each hypothesis.

Cindy Nero:

Hey. We are in a situation where there is still a lot of money in the system that is mainly invested in housing, stocks and financial products. After the money supply increases and an upward inflation cycle begins, money as such loses value and there are no incentives to save. There is the paradox that there is no general attractiveness in the stock market or in other possible investments with current valuations, but it is not too attractive to save either. It seems that the one who has liquidity and income fruits of previous investments such as housing rent or dividends, has to pay debts if he has them or simply consume while waiting to catch some other opportunity.

But things change for the one who has no money. Things like buying a home or borrowing have become unaffordable. The high costs do not allow saving and everything remains to live up to date as long as good employment rates are maintained. The problem is whether to trust that everything will continue like this for a long time.

Max Caro:

Hey. Central banks are selling us that they are opting for a very restrictive policy to combat inflation, but the reality is that they are not being so restrictive. The money supply is 40% higher than 4 years ago, rates are going up for loans and mortgages, but they barely do it for savings. They want the capital generated to be kept invested or used to reduce debt.

Companies have started reducing debt since 2022 and repurchasing listed shares. Families are also taking care of their debt levels, but they barely have savings. There is a fear of the debt, but the governments, for their part, are still running deficits and are going to have to face larger payments. Your debt can only be made smaller by inflation as this devalues its real value and at the same time allows you to raise more. If company profits and salaries rise in line with inflation, this is perfect to reduce public debt, but this is not going to happen. Governments are going to have to stimulate the economy and central banks will have to do it too. We have entered an insurmountable cycle of pyramid schemes where debt can only be saved with more debt.

Cindy Nero:

I think the oligarchy wants to shrink the economy and focus everything more on governments and a smaller number of companies. The rest will have no power and no chance to have it. We will have a society that will be much more controlled in exchange for having what is necessary with less effort.I think we will see a longer period of high rates and inflation that will generate recession and concentration of power, and that will end in a change of rules with greater controls and fewer freedoms. If debt is the only problem, it will be reset. It doesn’t necessarily have to be a bad or dystopian world like the ones in the movies, but we tend to that.

Max Caro:

I see something more traditional in terms of the way of governing. Control is already in the hands of a few and debt is the way they have to direct and generate labor force towards their interests. They will continue to fuel this and have proven for decades that the only thing they know how to do when economic problems come is to print more money. The rates, despite everything, are low for the inflation that there is. As soon as there are risks of debt defaults, a larger debt will be created to keep it afloat. Central banks have returned to buying gold because they know this. Coins lose their value when their available amount is increased, but they are necessary to cope with debts and the payment of taxes. Only physical assets and Bitcoin generate an alternative. For me it is still an unknown how the new technological advances will be absorbed, but these bases will not change.

Cindy Nero:

It is interesting to think what can happen now that there is a lot of money in the hands of a few, but they do not want to invest it. If it is fulfilled that we will have high rates for a while, there will be debt defaults and the lucky ones who have liquidity will be able to go to the market to acquire goods at a good price for debt default. It sounds cruel, but it’s a possibility that I don’t see as too unlikely.

Max Caro:

Everyone wants to collect their debt, but I do agree that it may be more attractive to do it in tangible goods and not in money. If we extrapolate this to international loans, we may see countries in the hands of others, if this is not already happening.

Cindy Nero:

In summary, I see that high inflation will help governments and maybe some companies for a while, but it will generate great class differences, destroying the standard of living of the middle class that will have fewer possessions, but more technological wealth and the possibility of escaping virtually.

Max Caro:

Be that as it may, we are going to a world of great differences between classes where you have to have real assets while you can and not fall into the debt trap unless you believe that the borrowed money is for something profitable.

Tod:

Interesting debate, although it does not see an easy future.

In the coming episodes we will be increasing our financial culture. We have talked about macroeconomics today, but we will talk about more topics such as crypto, energy, raw materials, housing, technology and many current news.

Deja un comentario