The latest market data brings us worse values than expected, but the stock market is going up. Is this crazy? We go into detail with data and analysis.

Consumer confidence is falling, although it is still positive. The job demand data are also down considerably from what the market expected. Annual GDP growth in the United States is also moderating.

These data suggest that the income of companies may be impacted downwards and that the increase in debt in recent years is not generating the expected wealth, increasing the risks.

The reaction of the markets, on the other hand, has been highly positive. The fact that central banks can shuffle lower interest rates, and larger amounts of liquidity causes the bad news to be good. This is on top of the fact that the results of companies may be worse, or there may be more risks of debt defaults, or consumption may be reduced.There is no indication that the central banks are going to change their policy. Both oil consumption and inflation will remain high.

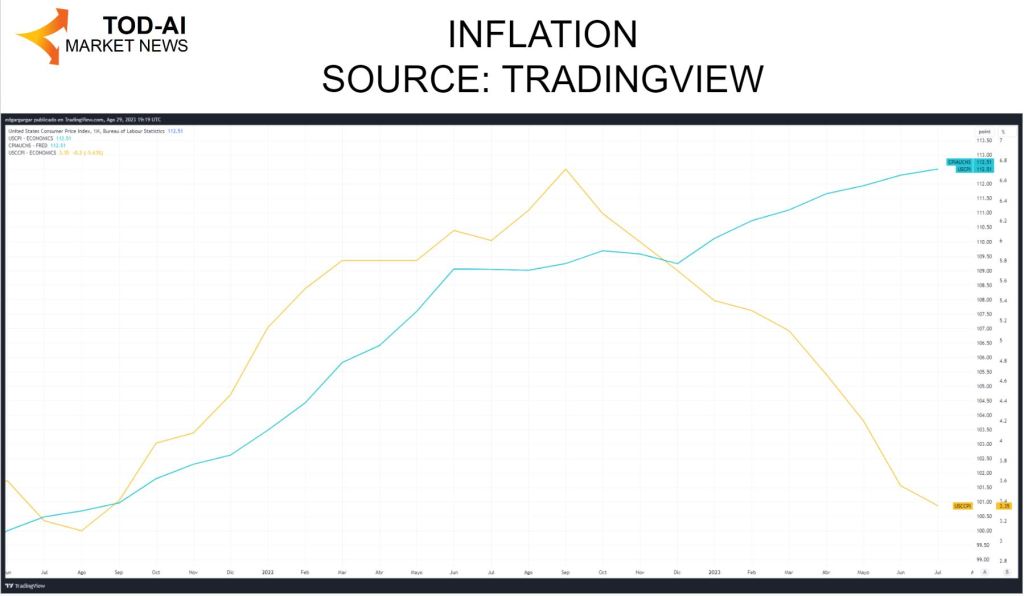

Inflation continues to rise. The blue line that is the two-year inflation data continues to rise, although the annual growth rate decreases. We keep paying more and more for things.

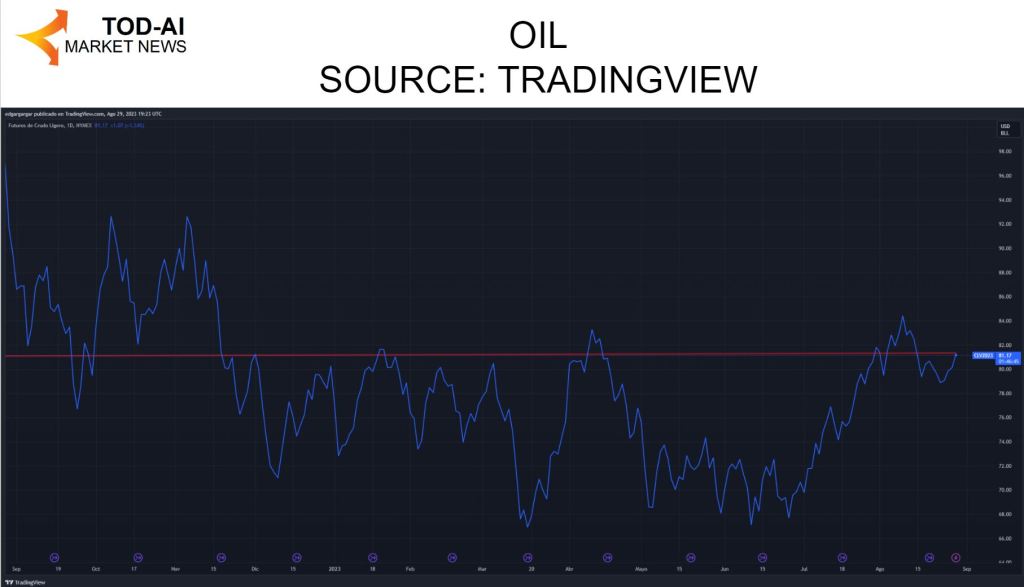

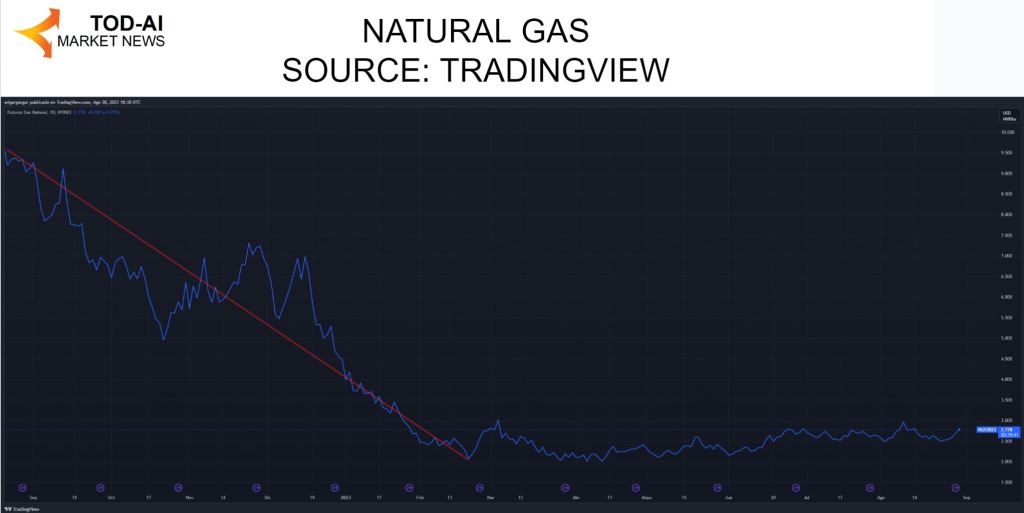

We see the charts generated with the Tradingview tool.

Oil is below its price a year ago, but in three months it will be more difficult since its price has fallen since the beginning of 2023. This is a lever for inflation to rise again.

The same with natural gas, but more accentuated as can be seen in the graph the pronounced decline it had last year. If the data gets worse and inflation doesn’t go down keeping the central banks’ tough policy, shouldn’t the stock market go down?

Opinion 1:

At the moment, inflationary tensions and oil consumption remain high. It does not seem, as you say, that the Fed is now going to change its policy. The reaction to the worse-than-expected data seems exaggerated to me, and if the results of the companies do not support them, it should end up being corrected. If we see less consumption, there will be worse results for companies and the stock markets will go down.

Opinion 2:

I see that with the high rates, it will cost more and more even to refinance the existing debt and there will be defaults. The Fed is going to have to lower rates and change its policy, but it is going to take a good part of the stock price ahead. I am a pessimist in the current scenario.

Deja un comentario