In a very short time, we will explain what the consumer situation is, how it is changing and how this affects the markets.

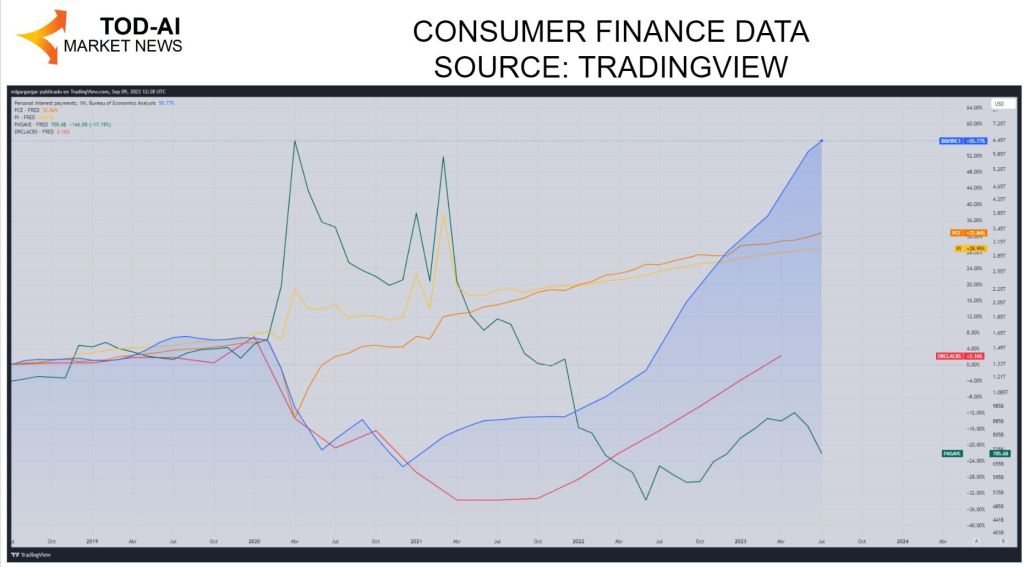

The consumer situation is undergoing drastic variations in recent years, with various trend changes that we will explain according to the following graph.

During the pandemic times, we see how consumer spending (orange line) has been clearly below income (yellow line), generating a higher savings rate (green line). During that period, inflation and the interest to be paid (blue line) were low, which reduced the percentage of defaults on credit card bills (red line).

With the return to consumption, expenses have exceeded incomes, also accentuated by the higher amounts of interest payable that have been greatly increased and inflation. This has lowered the savings a lot and the defaults on credit card expenses have increased.

Is the consumer in a position to maintain the economy or are we going to a recession? We hear different opinions about it, according to the philosophy of this program.

OPINION 1

At the moment, the values we see of delinquency are not worrisome, they are low. The consumer has security in being able to afford the payments and that is why he asks for more credits, and spends more. This is because he has a job and is confident about his future income.

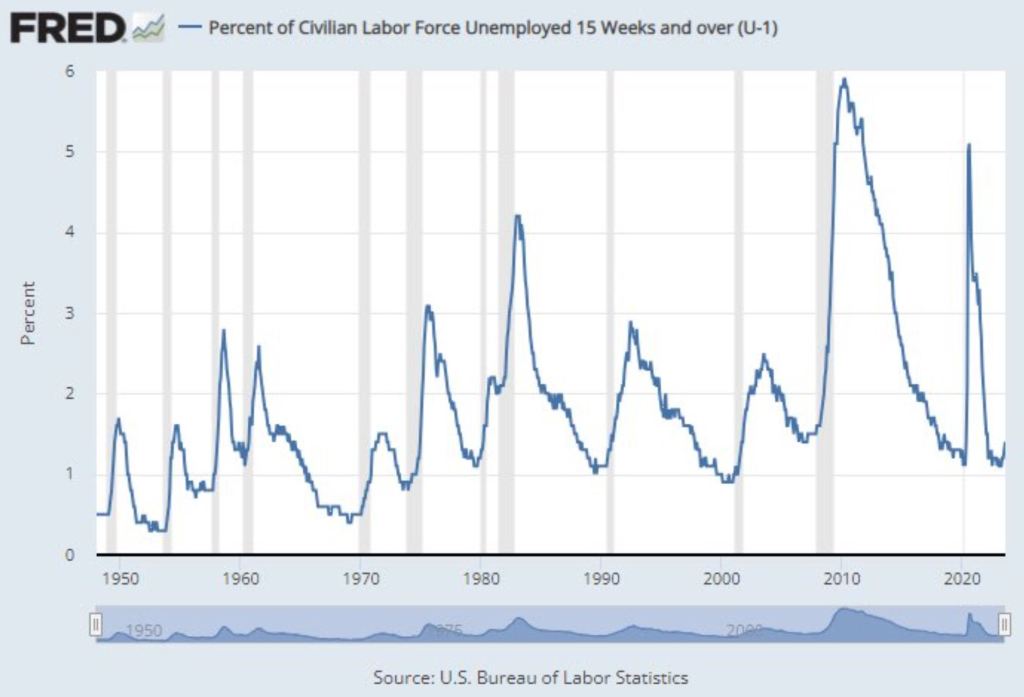

With the current unemployment rates, I don’t see any problems on the consumer side. Of course, if unemployment rises and it does so for several months, then it becomes a clear sign of recession as we see in the graph.

OPINION 2

If we look at it from the point of view of what companies are forecasting, the PMI index that reflects their sentiment regarding the demand they are going to have, it can be seen that in the last year it has been negative for several months in all the main regions (the United States, China and Europe). It is now only below 50 in Europe, but the trend is downward and towards economic moderation.

Big employers like Walmart are starting to pay their employees less. Link to news

This means that the consumer’s share of income may decline or lose the upward trend. If the spending part does not do the same (inflation and interest rates), then the consumer will not be able to sustain the economy. My prediction, unfortunately, is exactly that. The central banks have already warned that families are going to suffer and they are not going to change their policy because of that.

CLOSURE

In this program we have already commented that the central banks’ policy is not only based on reducing inflation, but also on ensuring that the energy supply meets the demand. For both purposes, they are reducing demand as much as they can.

Leave your opinion in the comments.

Deja un comentario