Hello!,

In five minutes you will know:

1.- What are the current global policies?

2.- How do they impact the economy?

3.- What to do accordingly?

1.- GLOBAL POLICIES

The data on the purchase and sale of goods and services between countries have been decreasing in recent years, as can be seen in the graph showing global trade as a percentage of GDP. This is because policies that favor domestic consumption and discourage foreign trade are being promoted.

Causes such as Brexit, the US-China trade war and the Ukraine war have fostered this.

While global trade data on costs incurred may have continued to grow, the volume of products involved has not. This is in line with the narrative of promoting less pollution of the planet since the transport of products and, therefore, the consumption of fossil fuels is reduced. It is true that the fact that each geographical area has its own factories, multiplies the centers of production of similar goods in different geographical areas, eliminating the optimization of production costs that could be taken advantage of by volume and synergies. The important thing is that local manufacturing processes can be done with renewable energies, in a much higher percentage than transport derived from export and import.

The measure that has been implemented at the global level in order to achieve greater deglobalization is to impose tariffs on imports. For example, importing from Russia to other countries such as the United States, Canada, New Zealand or the United Kingdom carries a rate of 35%.

2.- IMPACT ON THE ECONOMY

While the trend is clear at the level of trade in goods, it is not so clear on the services side. The rise of remote working has encouraged, in the first instance, a good number of workers to change their residence. My prediction is that the next step will be a move to outsource certain services in countries with cheaper labor, which allows to reduce costs without causing a negative environmental impact.

At the moment, the first consequence of deglobalization is inflation. To stop producing where it is cheaper and to do it locally with initial investment needs, causes higher production costs and price increases to maintain margins. Little or nothing is said about this in the media, but it means that the inflation we are suffering from is largely artificial and caused by global policy managers, and not by external factors.

The next step we have seen is not a massive deglobalization, but a re-globalization. The so-called BRICs countries have increased their number and established trade agreements. The United States has increased imports from Mexico, and so on and so forth. In the end we are going to a world of competition between two or three big blocks at most.

Yet another consequence is that a greater shortage of products has been generated due to the sharp drop in imports as seen in the graph where a rapid downward start can be seen, both in Europe and in the United States. What is not imported, is not replaced by other products and raw materials locally in the short term. This has also led to higher inflation.

Finally, there is the currency war. We are seeing how the dollar is getting stronger as an economy with more possibilities to survive independently and with a currency that is considered a refuge value in times of uncertainty. In the chart, we see the evolution of the purchasing power of the dollar in relation to the most relevant, according to the index created by the US Federal Reserve.

HOW TO INVEST IN THIS SITUATION?

The monetary policies of the central banks have been oriented to stop demand, in order to avoid product shortages, large price rises and exacerbated oil consumption whose supply cannot be covered. This last point is fundamental and is perhaps the greatest hidden truth behind all these policies. If it gets to a situation where the demand for oil cannot be met, we could enter an unprecedented crisis. That is why local trade is promoted abroad, that demand is stopped by raising interest rates, that price rises are caused so that less is produced, and that a shortage of raw materials is generated so that industrial activity and supply in general are also reduced.

The investments are now destined to boost renewable energies and to produce more natural gas and oil in areas such as Asia, Europe and America, to compensate for the decreases in imports from Russia or the Middle East. New deposits must be discovered and existing ones enhanced, until a change in energy sources can take place.

Let’s listen to different opinions.

OPINION 1

I think we are already beginning to see the consequences of all this.

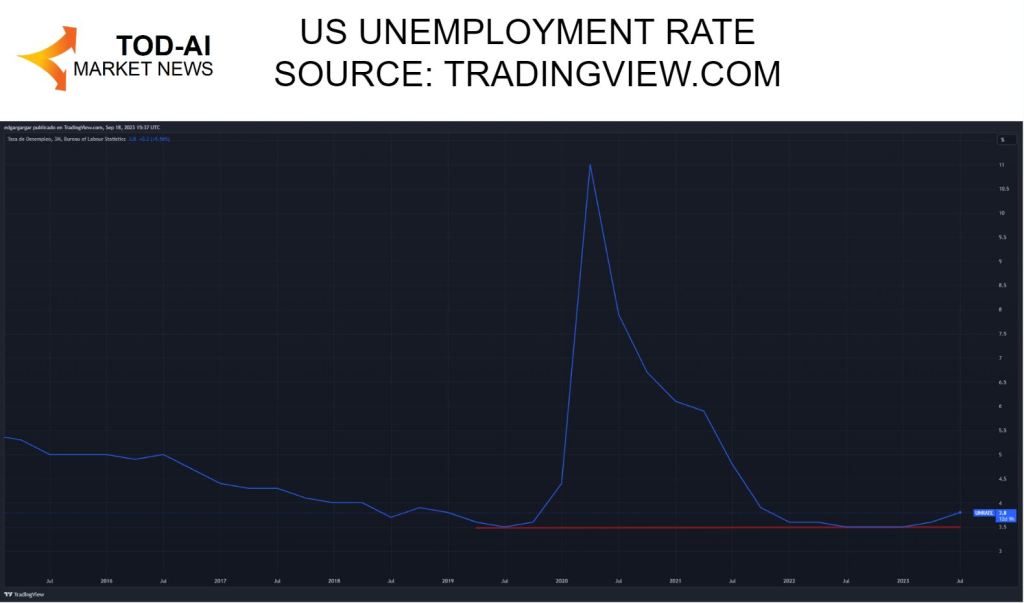

Perhaps the most important data is unemployment, which is already starting to rise.

Although it is still at low values, the trend change is being seen. A further rise in unemployment would be lethal for the economy since consumption would be reduced drastically, impacting on the results of companies. My opinion is to be cautious now, and only look at things that can cause to produce more with less energy expenditure, such as certain technologies or the renewable industry specifically. With the highest interest rates, although not exaggerated, I would reduce debt and avoid it as much as possible, as well as have liquidity.

OPINION 2

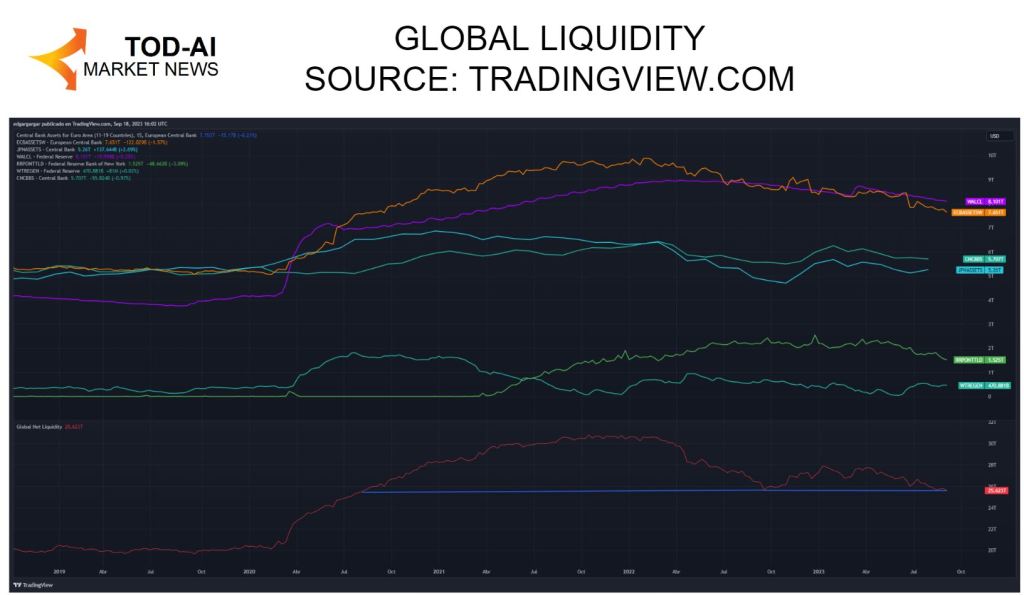

I agree with you. Another factor that I see within the reglobalization is that there are more hidden truths. The most important measure at the economic level is liquidity. This one is still high and it doesn’t look like it’s going to go down. While some central banks such as the US Federal Reserve are cutting liquidity, others such as China or Japan have been increasing it in recent months. In any case, none of them has compensated by far the increase in liquidity produced in 2020. It should be borne in mind that central banks have the same owners and that their policies are globalized.

The graph shows at the top the liquidity of the most important central banks (Europe, USA, China, Japan), and at the bottom the aggregate where it can be seen that we are at the same levels as one year ago and three years ago, when there was an expected increase of 40% to cover the economic problems of the pandemic.

With liquidity at high levels, the value of assets is not going to go down. There will be a recession as indicated in the previous opinion, but after the downturn, the central banks will come to the rescue by injecting liquidity, although they will not lower interest rates as long as there is a risk of running out of oil, so inflation will be caused.

Greater liquidity with a higher interest rate is a great advantage for those who have precisely liquidity. It will be easy to invest with her in a market that has gone down and that will be supported by injections from central banks. There will be opportunities for those who have liquidity so I recommend doing everything possible to have it. Luxury-oriented or low-profile companies will be in demand, while the middle class will continue to shrink.

OPINION 1

Good opinion. I, for one, see a longer period of economic stagnation. The recovery will not be so easy with high rates, there will be less investments. The liquidity is not going to reach the final consumer. The companies that have applied technology to be productive, if they will generate profits and that is where they will have to position themselves in the investments. On the other hand, many other companies are going to fall or stagnate. I don’t see a general recovery in a long time.

What you said about class differences is very clear to me. At least, until we see an energy miracle.

CLOSURE

Everything has its readings and what we comment on are our own opinions. The truth is that when you do your research you realize that deglobalization is not as big as they say, that the economic policies of the central banks are not being as restrictive as they promulgate. With the unemployment and the low savings rate that we saw in the previous episode, it seems that those who are going to be left with in favor are a few, as always.

Leave your opinion in the comments and subscribe for more economic information.

Deja un comentario