In this chapter we are going to analyze:

- What are the economic predictions of the FED (US Federal Reserve)?

- What data are they missing?

- What are our predictions?

- What happens if the Fed is wrong?

1.- FED PREDICTIONS

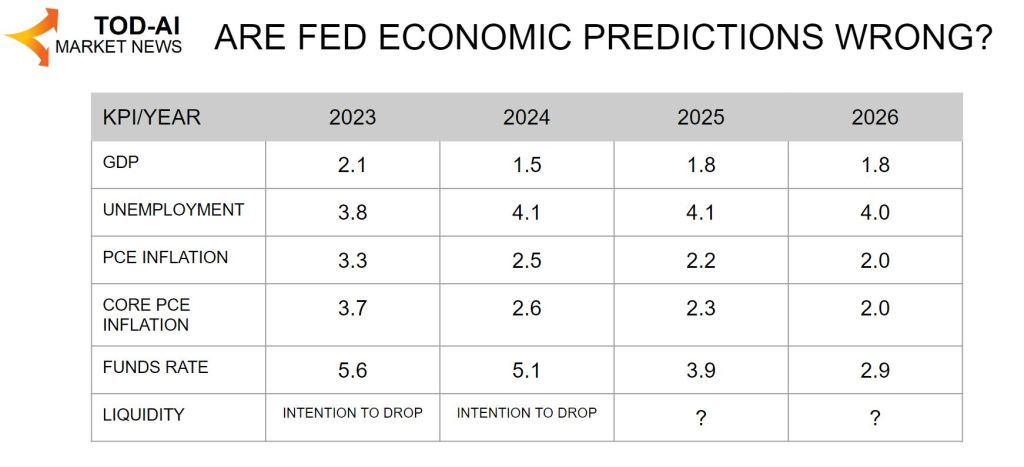

The Federal Reserve is the body that controls monetary policy with the main purpose of maintaining stability in prices. Its policy is based on the estimates that its members make. According to the report they have recently published, the economic predictions they have made for the next three years are as follows:

The US central bank is forecasting a mild slowdown in the economy, with smaller increases in GDP (Gross Domestic Product), but positive; stable unemployment levels; moderate inflation tending to the FED’s own target of 2%. In addition, they plan a rate cut starting at the end of 2024 and reduce their balance sheet and liquidity.

2.- DATA THAT THEY ARE MISSING

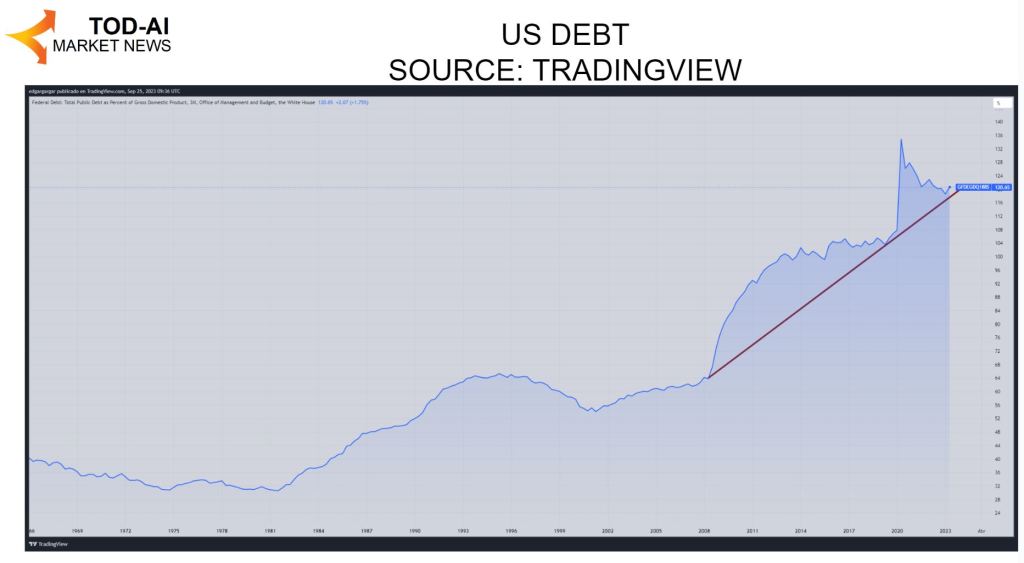

The main component that they are not mentioning is the debt. As you can see in the picture, they are making it grow a lot and, recently, it has been agreed that it can continue to increase until January 2025.

If to generate 1% of GDP, you need a debt five times higher, and this continuously, the management is not good and you can generate a lot of problems in the future. Of course, as long as it can be done, the GDP growth that has been estimated can be met.

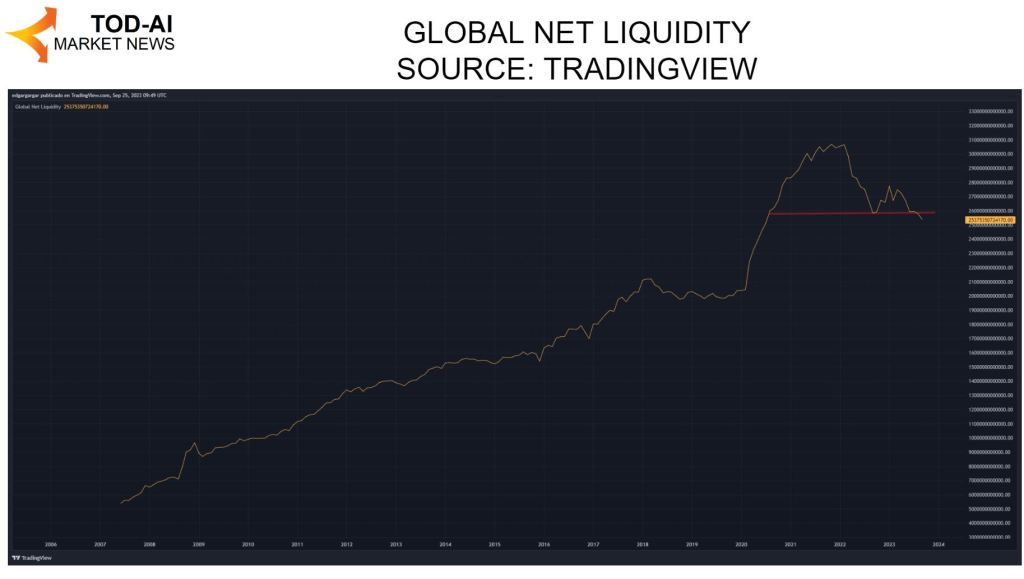

Meanwhile the FED and, beware, central banks worldwide are reducing existing liquidity, which usually leads with a fairly high probability to a fall in the markets. A technical resistance has been lost as seen in the graph :

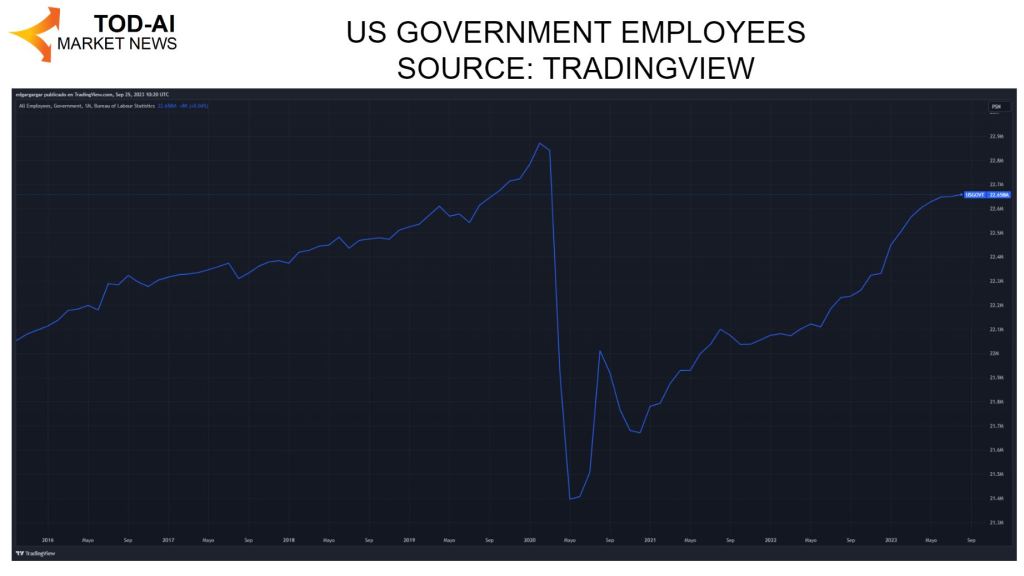

If the central banks do not encourage the economy, the one who has to support it is the government based on debt. On the contrary, public employment does not reach the pre-pandemic levels in the United States, as can be seen in the following graph:

The latest interest rate hikes mean that the interest payable on the previously mentioned debt is much higher, as can be seen in the following chart. In addition, this data will continue to increase, especially from November, which will mean that the public coffers will not be enough to be the engine of the economy.

With this crossroads, we are going to look at alternative predictions:

3.- ALTERNATIVE ECONOMIC PREDICTIONS

PREDICTION 1:

I think we’re going to see a bigger downturn in the economy than the Fed is predicting, but I don’t see it being overly dramatic until the end of 2025. Yes, there will also be more unemployment, but the public debt and money printing machine by the FED will be activated when necessary to prolong the narrative of a soft landing for two more years.

You can see my predictions in the table. I think that employment will last two more years at low levels, the debt will rise a lot and the balance sheet of the central banks will not fall so much, it will even end up going up.

I see a soft landing because family incomes and wages are responding to inflation and ensuring an acceptable amount of consumption with these levels of unemployment, even with a somewhat higher unemployment rate. The graph shows a positive evolution that is difficult to stop without a drastic change in the economy. As I say, it will come, but close to 2026. It will do so due to the aforementioned debt problems that will reduce public budgets for non-essential services, and all that this entails in private employment of third parties and investments.

PREDICTION 2:

For my part, I see a decline in the markets and the economy in the short term, starting from the date of November 2023. I think it will be a short decline because, effectively, the central banks and the debt will come to the rescue with more liquidity for the market and to contain unemployment. Additionally, I also believe that stability will not last long, and that in 2026 there will be a big fall and that it will cost more to recover because governments and companies will be forced to make budget cuts.

One of the reasons that worries me the most is the continuous and exaggerated deficit in which the public accounts have been in recent years. As you can see in the graph, this has not happened in all history since the 50s, or even something similar. We are going to a difficult decade with a strong and short downturn imminent, and a longer and steeper one from 2026. The first imminent crisis is going to occur because such a restrictive central bank policy was not expected and part of the income and investments that were expected will not occur. The second crisis will be due to the debt, as already mentioned.

What happens if the Fed is wrong?

If it turns out that the forecasts are optimistic, the first thing we will see is a fall in financial markets, even more pronounced than the economic data itself could reflect. This would lead to the Fed having to opt for more expansionary policies and higher government borrowing. Of course, the balance would never tip towards a large growth of the economy since, as we have said in other episodes, there is not enough oil to supply a larger energy demand.

Conclusion

As a closing, we can say that the Fed’s predictions seem optimistic and that there is a significant risk of seeing the markets lower, both in the short term and almost certainly near 2026.

References:

Deja un comentario