Today we are going to look for the real value of Bitcoin and Ethereum. For this we are going to see:

1.- Data about the Bitcoin Network

2.- Fundamentals and Facts about the Ethereum Network

3.- Opinions of what the real value of Bitcoin and Ether could be.

FACTS ABOUT BITCOIN

We already saw in the previous episode of Bitcoin, its fundamentals and the success it has had as a use case. The different metrics about the Bitcoin operation remain positive as we will analyze below.

The Bitcoin system is based on the fact that several actors voluntarily offer their computing capacity to process transactions and store their history in exchange for being able to obtain Bitcoins as a reward, as established in the Proof-of-Work consensus algorithm (the first to solve the proof-of-work process the next block and obtains said reward). The total computing of the Network is what is known as Hashrate, and as shown in the following graph it continues to rise indicating that the state of the Bitcoin Network is healthy and offers a lot of security.

Imagine creating a system whose contributors grow and provide the necessary infrastructure to make it work because they trust in the value it provides. Bitcoin is a success in that sense.

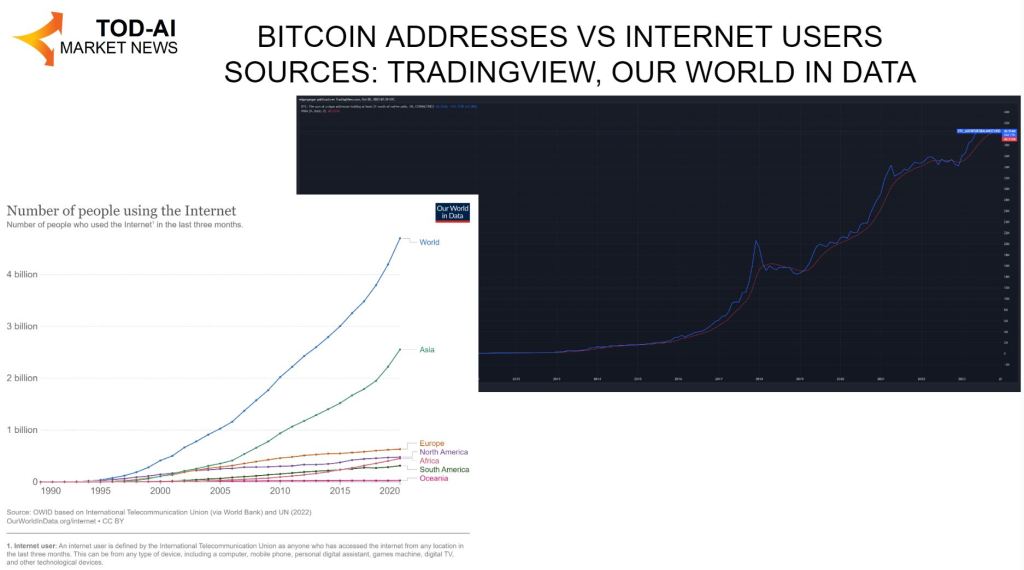

The main use of Bitcoin is to store value. To have a hard, transferable and easily exchangeable digital asset at your disposal without being guarded by a third party. If we look at the evolution of accounts with at least one dollar of stored value compared to the evolution of Internet users, we find quite a similarity. Bitcoin 15 years ago in January 2024, just when the number of Internet users began to grow exponentially as we see in the following graphs:

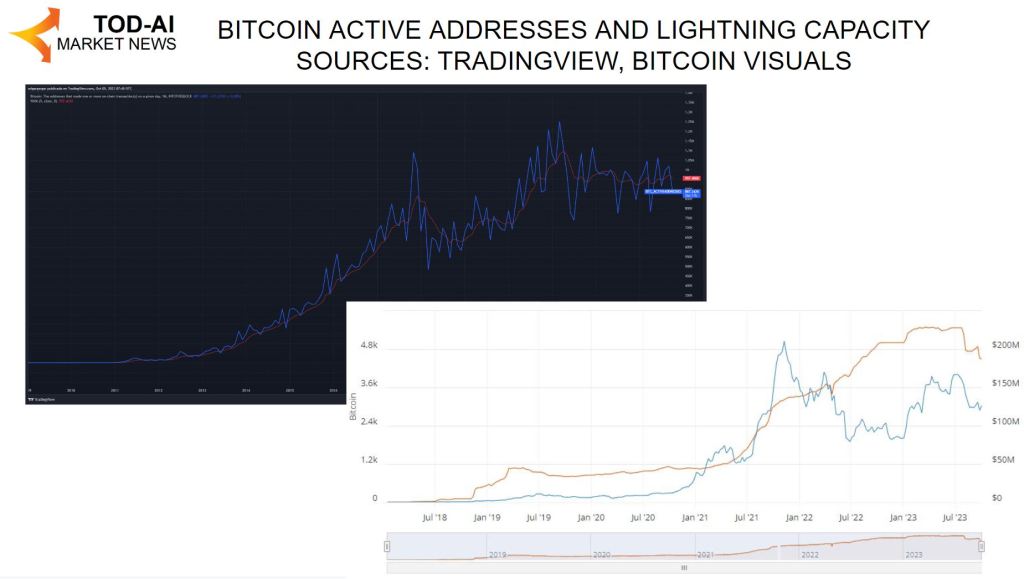

The following use cases of Bitcoin are the use as a means of payment or short-term investment. If we analyze the evolution of active accounts on the Bitcoin network every day, we see that the increase in usage slows down. This is because Bitcoin technologically does not allow a large number of transactions to be used on a large scale as a means of payment.

Due to the above, a new second-level Network called «Lightning» has been developed that does allow the massive use of Bitcoin as a means of payment and that is already a success as well. The community has already created the infrastructure and the number of nodes necessary in the Lightninig Network so that 25% of the total Bitcoins can be used. The number of businesses that accept it, as well as the number of users that use it continues to grow and this is where there can be an exponential growth.

The orange line corresponds to the capacity of the Lightning Network in Bitcoins, and the blue one in dollars. The chart above shows the active accounts in Bitcoin. The sum of the two gives us an idea of the use of Bitcoin as a means of payment.

Using Lightning Network is cheaper than Visa or Mastercard. In addition, it is starting to be supported by large entities such as Santander due to the number of transactions it can allow per second.

The Bitcoin community has also developed new use cases to be implemented on the Bitcoin Network, such as the NFTs, as we saw in the previous episode. This generates other uses of the Bitcoin Network as demonstrated in the graph indicating the average size of each block. The additional information that is stored for the NFTs is the cause of this increase started at the beginning of 2023:

THE BASICS OF THE ETHEREUM NETWORK

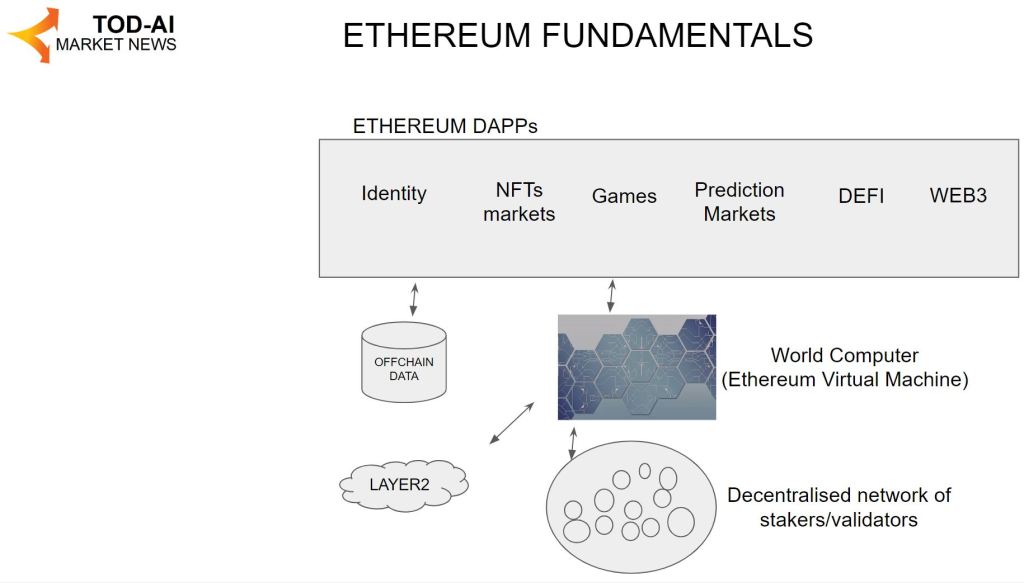

Ethereum was born in 2015 under the leadership of Vitalik Buterin, as a decentralized ecosystem based on a blockchain different from Bitcoin, designed to be able to execute smart contracts. These are pieces of self-executing computational code based on rules that are reflected in the code itself. This allows the creation of decentralized organizations where their members can exercise votes on the rules to be applied, but the execution of them is carried out by the implemented machine code, avoiding human corruption.

Ethereum uses the Ether token for the payment of the computational cost it entails, also known as «gas».

There are numerous use cases of decentralized applications that can be implemented on Ethereum. All are based on a more transparent and democratic governance, the elimination of costs and benefits of intermediaries, greater distribution in production and in the revenues associated with it, and greater security, among others.

Examples of use cases that can be implemented on Ethereum are:

1.- Tokenization of assets. To have a representation in a unique and transferable digital token on some physical asset or not. In the case that it is not interchangeable, such as a work of art, then it is an NFT.

2.- Decentralized Finance, DEFI. Here we talk about loans, deposits, investments, means of payment, etc.

3.- Identity systems. It allows the management of identities, so that the user controls his information and who consumes it, not an intermediary. This improves privacy management and is also the basis for the possibility of creating Web3 applications.

4.- Web Applications 3. They allow users to participate in the government and have a greater proportion of the benefits, by eliminating intermediaries or owners of a system. Based on this, use cases arise such as:

5.- Social networks. Users can enter tokens for the content they publish.

6.- Games and virtual worlds. Metaverse. Users can create assets, buy them, rent them, etc. within a virtual world.

7.- Online advertising. Advertisers, space owners and consumers interact without intermediaries to manage the advertising that is shown to whom and how the advertisers pay is distributed.

8.- Shared production. For example, several agents share the energy they produce and enter tokens that are paid for by consumers.

While, the Bitcoin community has also created tier 2 networks that allow for such use cases (example Stacks), Ethereum has been postulated as the leader for them.

ETHEREUM NETWORK DATA

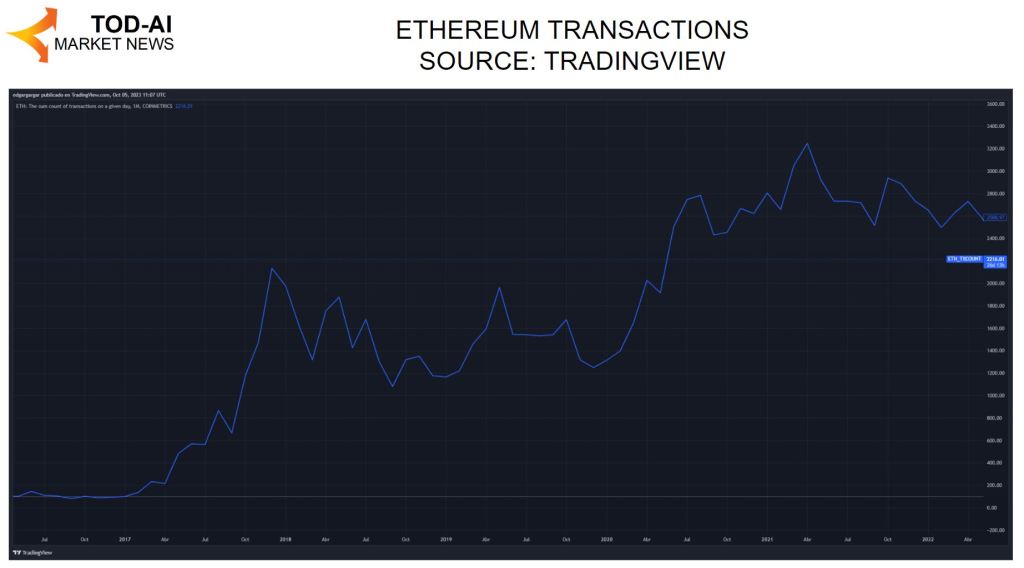

Although all these possibilities have generated a lot of enthusiasm, Ethereum has had to evolve to allow a very large volume of transactions and that does not involve a high energy cost. Although many of the new features have already been implemented, they will not all be completed until 2024. The use of tier 2 networks has also come to Ethereum to improve its functionality and this is important to understand the data also in Ethereum.

The first thing we are going to see is the support of the community to provide the necessary infrastructure to process transactions and smart contracts. The graph above shows the computing power while Ethereum was running on the proof-of-work consensus algorithm (same as Bitcoin), and the graph above shows the amount of Ether stored as proof of stake due to Ethereum switching to this consensus algorithm. The data reflects the total success of Ethereum in this regard.

If we look at the number of accounts created, we also see a very big growth:

The number of daily transactions carried out also shows an increase, reflecting a greater adoption of Ethereum:

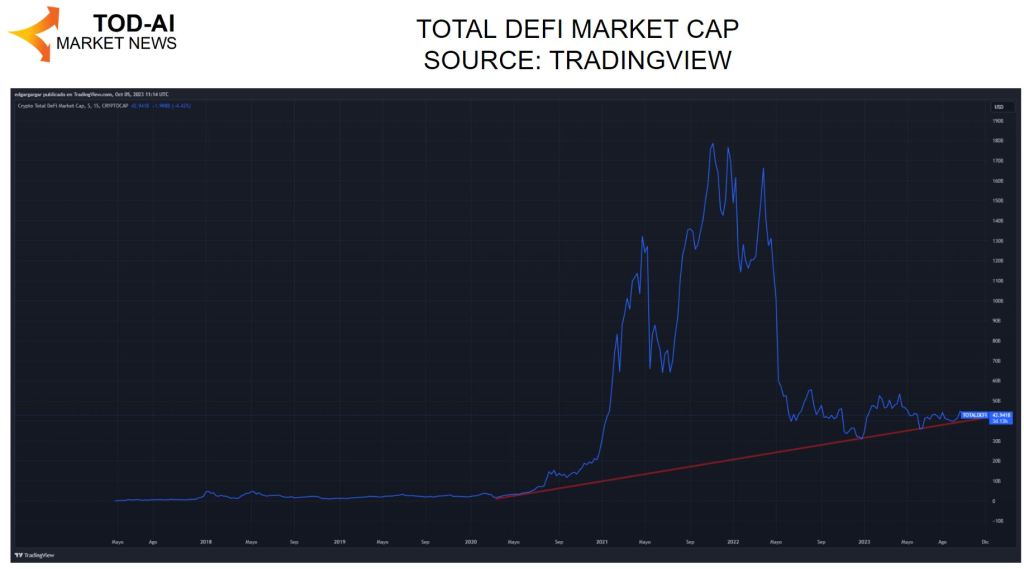

As for the use cases, the evolution of the total capitalization of DEFI projects (where Ethereum is the first in the ranking), shows growth, although it has decreased from maximum:

As for NFTs, there was also an explosion that has now been reduced, both in the value of NFTs and in the number of transactions, according to DEFILAMA data.

Despite the decrease in the use of certain assets, developers continue to increase their activity, which indicates that new applications are going to be implemented and that all the mentioned use cases are going to be enhanced. We can see this in the graph of downloads of the packages needed to code the applications that we get from the npmtrends source:

In short, to date we see a high degree of adoption with the potential to grow quite a lot. Both the infrastructure support, the interest of users, and the pace of new developments point to a greater importance of both Bitcoin and Ethereum and Web3 systems in general.

Now let’s analyze what the value of Bitcoin and Ethereum could be. In no case are we recommending to buy or sell.

OPINION 1

I think that with the data we have seen, the forecast of adoption of Bitcoin and Ethereum are going to be fulfilled.

If we look at the graph of the evolution of the value of Amazon, it is appreciated as in the bubble period «.com» rose a lot, but then fell by 90% to return to its previous value as we see in the lower graph. However, when the exponential growth in the use of the Internet began, it was very well positioned and rose to much higher levels. Even in the upper graph that shows the complete historical, the rise of the year 2000 is almost not appreciated. With this analogy, we could see Bitcoin values above $600,000 and Ether values above $40,000. We must also think that Amazon’s first source of income is cloud computing, something similar to what the Ethereum token represents.

In my opinion, the current value is below its potential and, in the long term, we will see those levels much higher.

OPINION 2

The cryptocurrencies Bitcoin and Ethereum are assets that have been created new and that should be viewed differently. Bitcoin is a digital asset limited in quantity, whose monetary mass grows, but to a lesser and lesser extent after each «halving» as seen in the top graph. Ethereum, on the other hand, represents the computing power in an ecosystem with many services and whose monetary mass has stopped growing to move to a very gentle decrease.

When you create new assets of great value and this one goes up, the relative value of others decreases. As we are going to a world where many assets are manufactured with little effort, this type of digital tokens are in high demand and cause a transfer of value from the more traditional products of now simple manufacture, to these others.

I believe that we are still at an early stage of this transfer of value and that it is going to take place even faster than what happened in the case of Amazon.

OPINION 1

In the case of Ethereum, it must be taken into account that there will be more and more computational supply with fewer and fewer existing tokens, so the price of each computing unit will be lower in Ethers. This will make fewer Ethers equal more dollars with the same relative value. If the use of Ethereum increases, the value of Ether will explode. With all the use cases it can support and its technology, I see it as having more potential even than Bitcoin.

One thing that impresses me about the invention of bitcoin, is that the «halving» occurs coinciding with changes of economic cycle. If we enter a recession cycle with rate cuts in 2024, halving will again coincide with a change. For me, both things influence the bullish cycles that Bitcoin has had.

In the graph we can see the vertical red lines indicating the «halving». The orange line corresponds to the existing Bitcoins and the blue line is the value of Bitcoin on a logarithmic scale that visually best represents the historical evolution of the price. The next «halving» is scheduled for March 2024.

OPINION 2

I think that Ethereum may also suffer from the competition of other ecosystems that are emerging, as well as from a more centralized government with a very marked leader such as Vitalik Buterin. In that sense, I see Bitcoin as safer.

As for the cycles, between now and the next «halving» I think we will continue with a low volume of transactions, which will lead to volatility in the price. The changes that there may be now with a low volume of transactions do not seem significant to me and I would not get carried away by them.

In the graph you can see how the current volume is low, more taking into account the growing number of users who are mostly storing for longer term.

Regulation is also very important and we will see if there are no obstacles to the smooth use of Bitcoin and Ethereum with all the possibilities that we have discussed.

CLOSURE

Thank you very much. We will continue to report on crypto on this channel.

You can check references in the comments. We appreciate your own comments.

Subscribe for more from economics that pursues the truth.

REFERENCES

Deja un comentario