The Israel-Gaza War. This can have major consequences for the world economy. However, there are various opinions of what they could be or, even, that the economy continues on its course without being affected. We analyze it below with data that will be surprising to you.

OIL

The first data to analyze in times of war is oil, and this is where we are going to see the first surprises.

Oil is worth the same today as it was in 1973 before the Yom Kippur war, if we weigh it with the US money supply (M2). In the graph above, we see the evolution of the oil price weighted with the money supply, it had a high price after the war, from 1973 to 1982, almost a decade until the market could be reestablished to achieve stability.

The graph below contrasts this, where we see the evolution of oil in orange, and that of the money supply in blue. There have actually only been four big milestones for oil to go up or down hard in 50 years:

1.- The aforementioned Yom Kippur war. 1973

2.- Iraq War. 2001.

3.- Arab springs. 2011.

4.- COVID-19 crisis. 2020. In this case the price went down due to lack of demand.

THE SITUATION OF THE UNITED STATES AND THE WEST

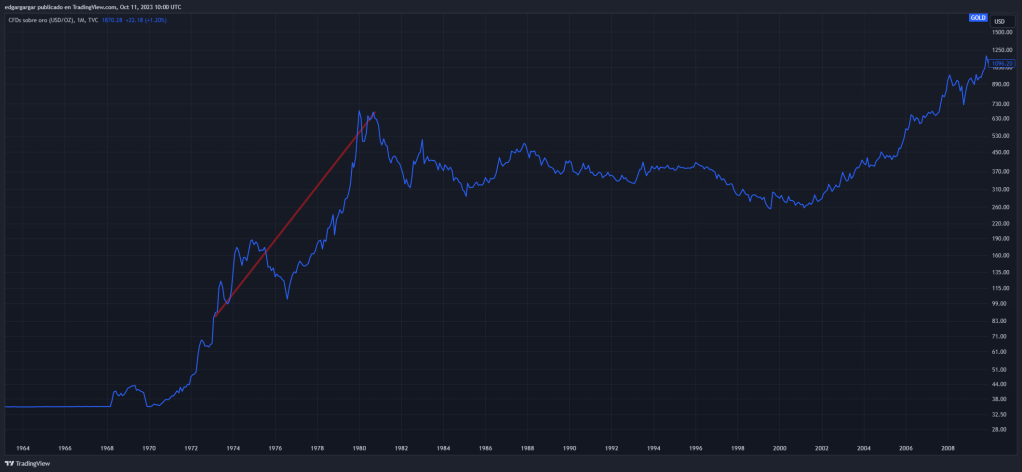

The situation of the West is not the most suitable one to finance a war and an energy crisis. Inflation does not go down to the target 2%, and these things do not help. We could even have another strong rise if the same thing happens as in the 70s, as we have painted on the red line, guaranteeing a strong recession in the year 2026.

Debt to GDP has reached levels higher than those immediately after the second World War in the United States, but also in the West in general. Since the dollar left the gold standard in 1971, it has not stopped growing. There is less and less room for the debt to continue rising.

In the following graph, we see the data of the US 10-year bond compared to inflation. In the 70s, a 10-year bond of 7% did not contain a new stronger wave of inflation. The Federal Reserve, in its statements, maintains a harsh tone, indicating that it is necessary to keep rates high for longer, and that having them below 2% does not seem feasible right now.

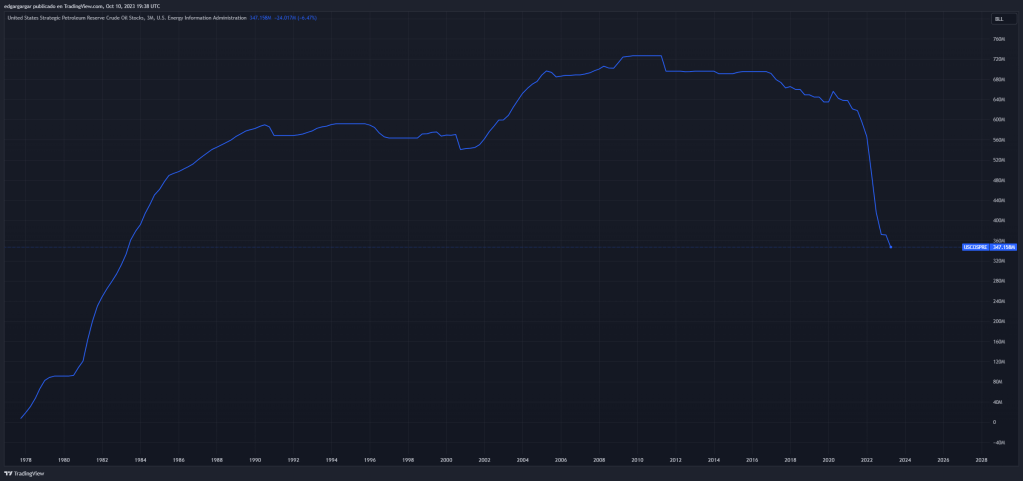

Oil reserves in the United States have fallen to levels not seen since the early 80s.

For a long time there has been no investment in searching for and exploring new deposits. Now it is being done, so as not to depend so much on other countries like Russia, but at the moment there is a risk of shortages. We have already said in this channel that there is not enough oil to support economic growth, and that this is the main reason for the rate hikes. These conflicts can only aggravate this situation.

Finally, the purchasing power of the dollar in relation to the other major currencies has been on the rise in the last twelve years. This creates an obstacle for exports, but importing products to the United States is cheaper, such as buying oil. By contrast, in Europe and other non-producing places, an expensive oil with an expensive dollar, raises energy prices in their local currency.

THE ROLE OF IRAN

Iran has not declared that it has supported the Hamas attack, but it has stated that it is against Israel’s attacks. Iran is a large oil producer and has a very important role in controlling the Strait of Hormuz, through which not only oil, but also Liquefied Natural Gas is transported.

It is in Iran’s hands to generate a new energy crisis, at a time of already high prices, and a lot of debt. We could be involved in a big recession and with runaway inflation.

BITCOIN

What does Bitcoin paint in all this? Bitcoin cannot be censored, confiscated, or created to a greater extent than is scheduled. This is a great shield to avoid wars, just the opposite of what happens with ordinary FIAT money.

It can be a great store of value in times of uncertainty. We move on to the opinions where we will talk about the impact of the war on Bitcoin.

OPINION 1

The most decisive factor for the economy and the markets will be, as always, the liquidity generated by central banks. With the exception of China, all the major central banks have declared that they want to lower liquidity. This leads to less investment and a reduction in the value of assets.

In the graph you can see how, after a big increase due to COVID, liquidity began to reduce until October 2022, but since then, it had not been reduced again in almost a year. Now it seems that this trend will continue, but the war could turn the tables, to avoid the collapse of the markets.

What is certain is that the debt will continue to increase.

OPINION 2

The debt will reach 200% of GDP in the next 3 years in the United States. Inflation will make the amount of debt in dollars, suppose less in other assets. Inflation will be necessary to be able to pay the debt, and to be able to assume inflation, the bankruptcies of other energy-dependent countries will be taken advantage of, which will not be able to pay their debts and will be exposed to great powers such as the United States.

The United States and China, mainly, are going to own valuable assets of other countries by debt embargoes. The game is for others to break, to have more world domination.

In these times of inflation and uncertainty, hard and defensive assets will be revalued. In the 70s, the price of gold increased almost 7-fold.

OPINION 1

Bitcoin can also be favored as digital gold today. The economic cycles that force central banks to expand liquidity, cause its value to rise. This is coupled with the fact that the growth of existing Bitcoins is reduced in March 2024, the number of users is going to increase exponentially, as an alternative to the banking system in times of crisis in many countries. In addition, the approval of ETFs will make institutional investors enter, favoring the price in the short term.

In my opinion, yes, I do not think that ETFs are good for Bitcoin in the long term, unless the Bitcoin reserves they hold are equivalent to what their investors have deposited.

OPINION 2

I think Bitcoin will rise, but in the next cycle it will do so to a lesser extent due to inflation. This is something that has not happened in the history of Bitcoin and it can harm you, because the dollar will also become a safe haven value, and it will make you competition. There will also be a selling pressure, due to the need of users in the face of economic problems. This will happen, above all, in 2026, in what could be the next bearish cycle.

CLOSURE

Thank you very much. Very volatile times are expected, and we will have to be aware of the changes. Don’t forget to subscribe for more economic information that seeks the truth. We also appreciate your comments.

Deja un comentario