Several relevant economic data have been published in recent weeks. We will explain them below, detailing the data in the correct order for your better understanding, as well as our forecasts. We will tell you the truth exclusively in a few seconds.

The first important fact is the balance between oil production and consumption. Within an economic growth, a higher demand for oil is expected, which could mean that there is not enough of this raw material available.

The balance is now positive, but not risk-free considering that it is considered very difficult to exceed 105 million barrels per day, a level that could be demanded between 2025 and 2026. That is why many central banks have decided to raise interest rates in order to stop economic growth. Brazil (yellow line) started in 2021, USA and Europe in 2022. Only China has relaxed the interest rate in the last two years.

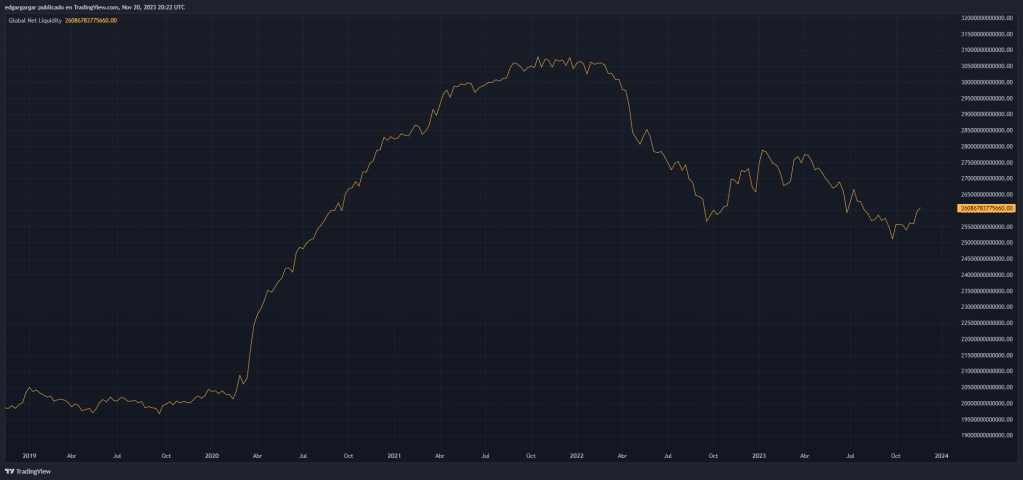

Central banks globally have kept liquidity high since October 2022, despite the fact that rates have continued to rise. This is intended to keep the economy and markets afloat. Global liquidity is 30% higher than in February 2020.

The markets have reacted with joy to the liquidity injections, being now also about 30% above the pre-pandemic value, driven mainly by technological securities.

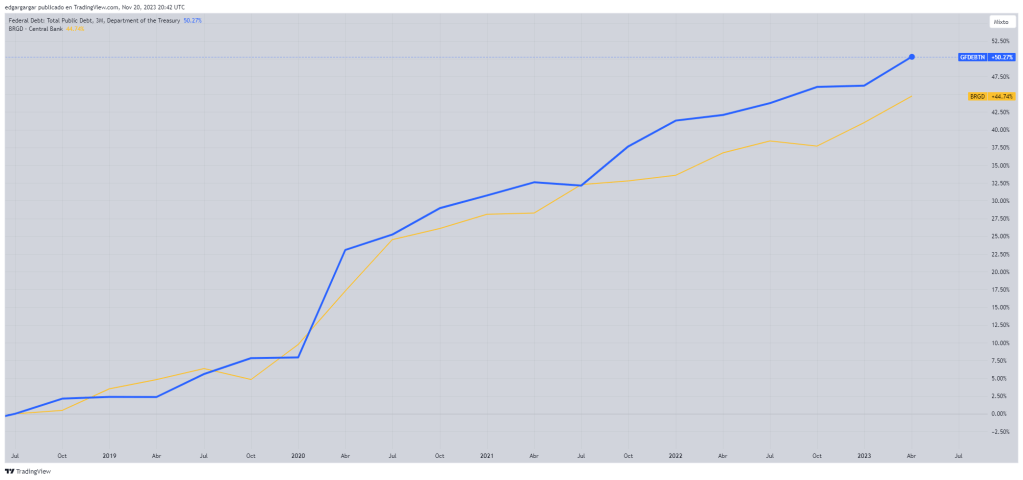

Governments have also taken advantage of the increased liquidity to expand their debt. The graph shows the examples of the United States and Brazil that have increased their debt by about 50% in 5 years.

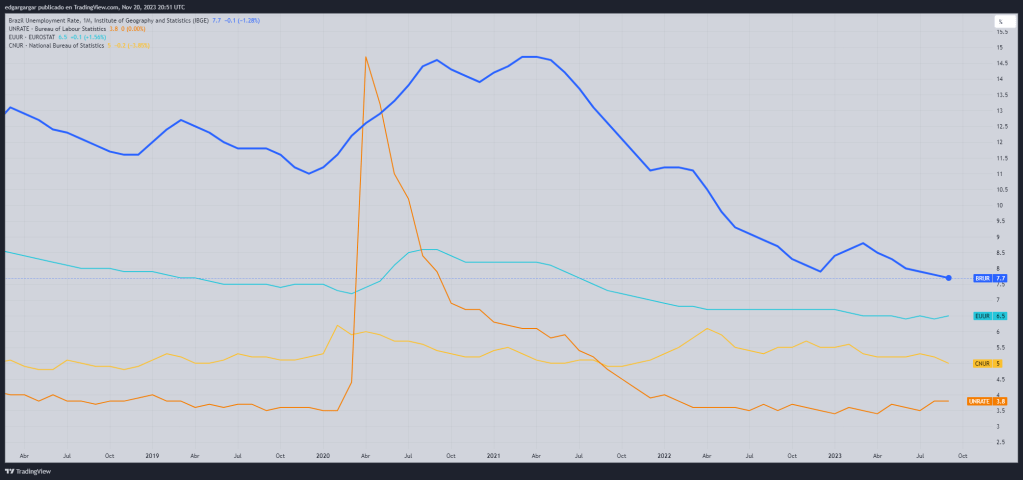

All this joy has kept the employment data in good numbers, even somewhat better than those of 2019. In the United States and in Europe, a worsening is beginning to be seen, but it is still pending to be confirmed in the coming months.

But this joy has generated inflation as well. More money has meant higher costs and that everything is significantly more expensive. For example, inflation in the United States has risen by almost 23% in just 5 years. In the last month it has declined, raising hopes of a moderation or even a change in trend.

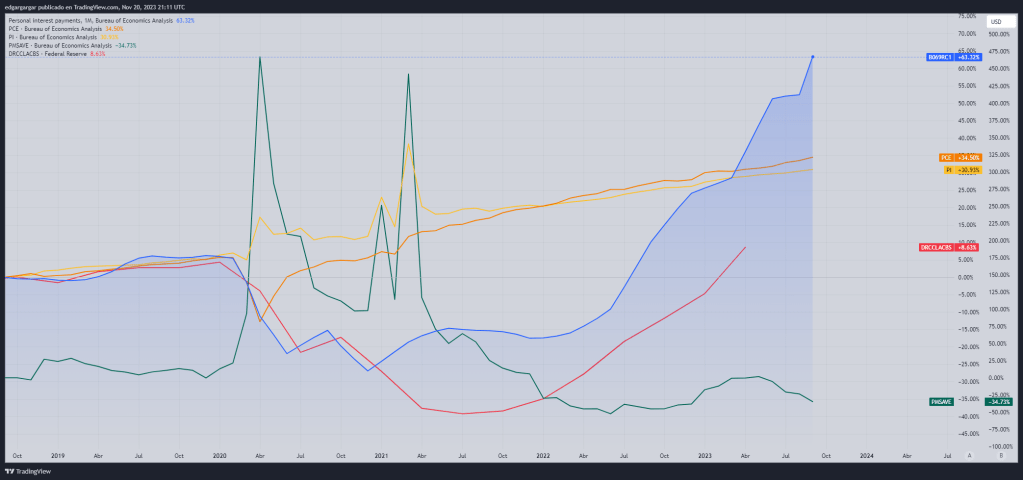

But the consumer has been impacted. What he pays for interest (blue line) has risen by more than 60%, credit card defaults have reached almost 9%, his expenses have risen by 4% more than his income, and savings are 34% lower than 5 years ago, despite having risen a lot during the pandemic. The consumer is being exploited whose numbers are getting worse, and in addition he is ultimately responsible for the large public debt.

If the consumer cannot sustain the economy, it does not seem that the government will be able to do it either. The huge increase in expenses that it has to face for debt interest payments leaves very little room for maneuver to stimulate the economy. The government needs more liquidity and inflation to better cope with the debt.

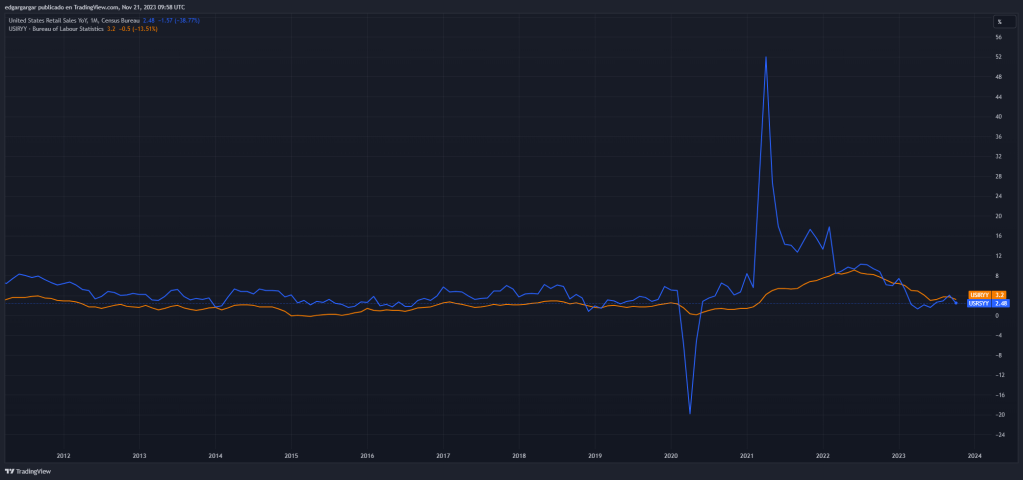

The companies have presented good results, but warn that the future may be worse. Since the end of 2022, retail sales have been growing below inflation. This can accentuate the rise in unemployment and the beginning of a recession.

We see different opinions.

Interest rates have surpassed those on 10-year bonds. This is not normal and raises the risks of recession and deflation. The story here is long. The state has a worse valuation of its debt now and has to raise the interest, so that the buyer is attracted to buy such debt with greater risk. This caused the investor to take the money saved out of the banks, and put them in the debt that offered better returns. This has forced the Federal Reserve to raise the rates above those on the 10-year bond, so that the banks maintain liquidity. The Fed cannot lower rates, which reduces lending and, therefore, economic activity. These contexts are more about saving and reducing debt as much as possible.

The fact that banks now need liquidity is patent. This is precisely why they are reducing the amount of money leveraged daily in the REPO market. Banks’ income may rise with higher interest rates, but so do defaults and they need to hedge against possible risks.

The problem is that the yield on the American bond cannot fall much until the United States improves its debt rating. The Federal Reserve has to keep rates high and also liquidity, which is quite unusual. In principle, we will see that the market is going to buy American debt and the dollar will be strong with respect to other currencies, but not in relation to raw materials or digital assets. The markets will fall due to the damage of inflation, and consumption, but liquidity will be able to sustain them and even recover. The great crisis will come when the government has to reduce debt and expenses at a time when, in addition, oil will not be enough, we believe that the end of 2025 or 2026.

It’s not going to help that China stops growing as it has so far. Neither is India. These countries are also victims of the shortage of raw materials. Money can be printed, but not raw materials. Other growth models have to be looked for, but at the moment they are not being implemented.

Our prospect of a major crisis in 2026 is still on foot, with more reasons than ever.

Deja un comentario