Today we are going to see:

1.- Fundamental concepts of Artificial Intelligence (AI).

2.- Where you can invest.

3.- Exclusive expert opinions.

Let’s prove that it has no comparison with the «.com» bubble.

THE BASICS OF ARTIFICIAL INTELLIGENCE

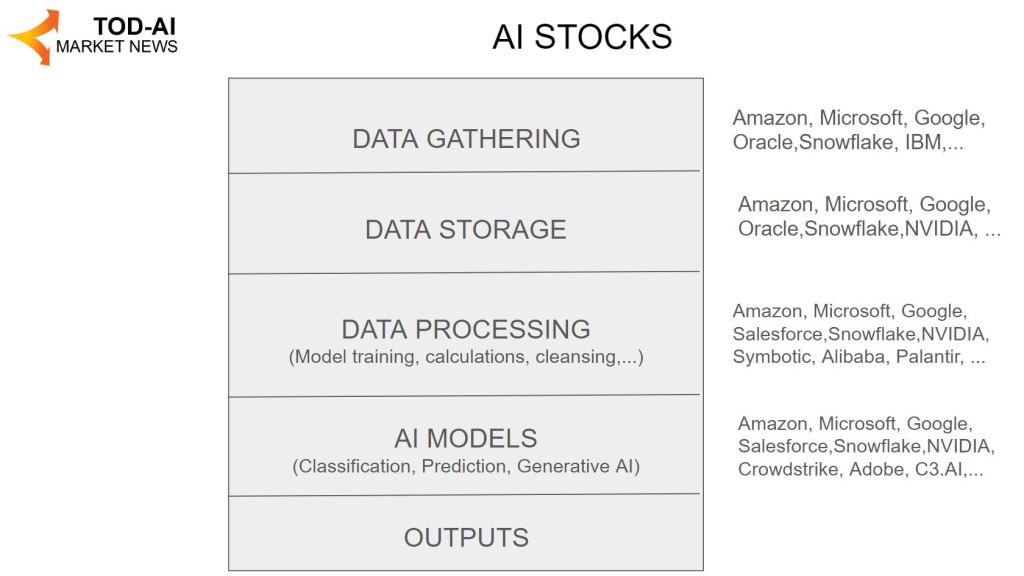

For the investor, it is important to note that AI requires energy and raw materials to work. The computational demand for many AI functions is great, which is why the needs of large data centers are expanding, which can store and process all the necessary information in an agile way.

All kinds of devices, sensors and, also, information generated by humans arrive at data centers as a source of AI.

All this data is stored in the appropriate format to apply the AI algorithms that allow, among other things, to classify the data; predict future values; answer questions; generate tailored information; or detect fraudulent behavior, among other functions.

The results of AI return to the real world, to make it more effective and powerful. Of course, not without risks.

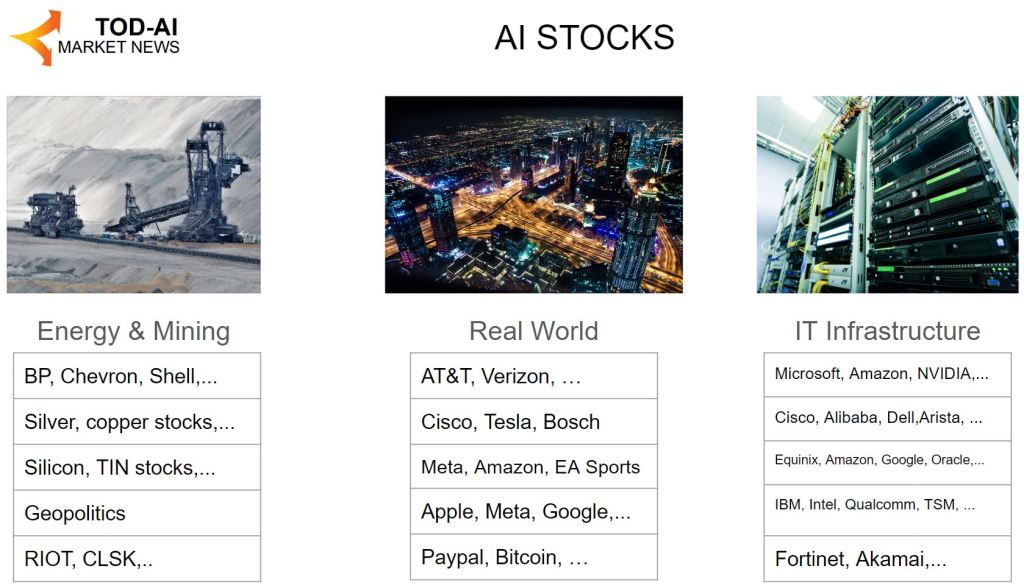

WHERE TO INVEST IN AI?

First we have to take into account the bases that we mentioned for the AI to work. Their costs will depend on the prices of energy or raw materials. On the latter, new ones may appear such as TIN, which is fundamental in quantum computing, in addition to silicon or copper.

Geopolitical risks are going to be present and no power is going to want another to have an AI more powerful than its own.

Companies that manufacture smart devices for the user, as well as those that make them for computer centers, will also play a very important role. All hardware is also accompanied by software where Apps, such as solutions for cloud computing are fundamental.

Web3 applications will not leave aside AI, where means of payment and cryptocurrencies will also be crucial.

About this, we show a list of actions as a representative of each area that you may find interesting to know where to invest. Of course, not all of them are there, but I like to indicate how several companies operate in various sectors.

As for the most niche actions in the sector, we have repeat companies and more specific new ones. Many of these companies have greatly increased their value. We leave a representative list on the screen so that you can investigate them yourself.

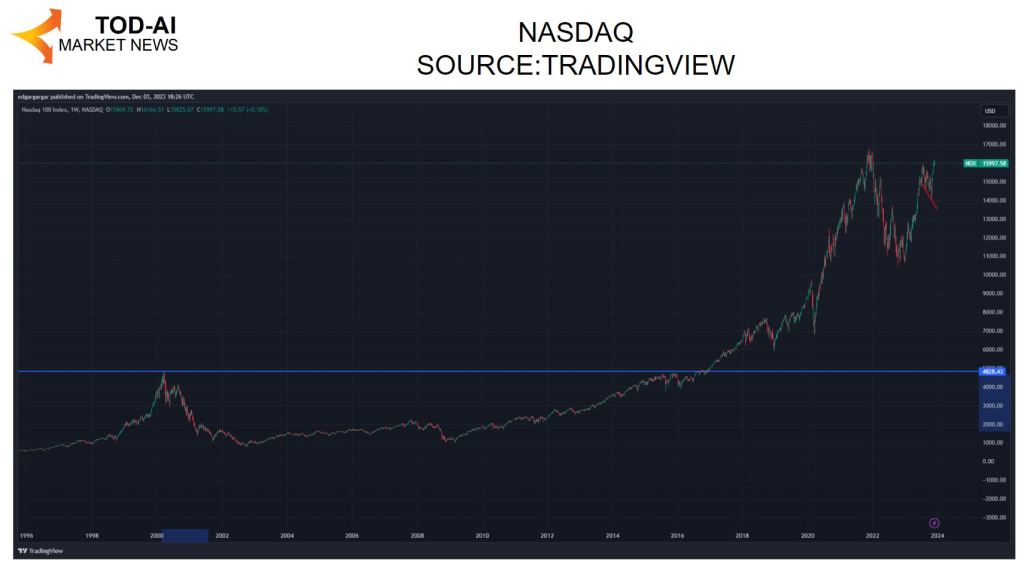

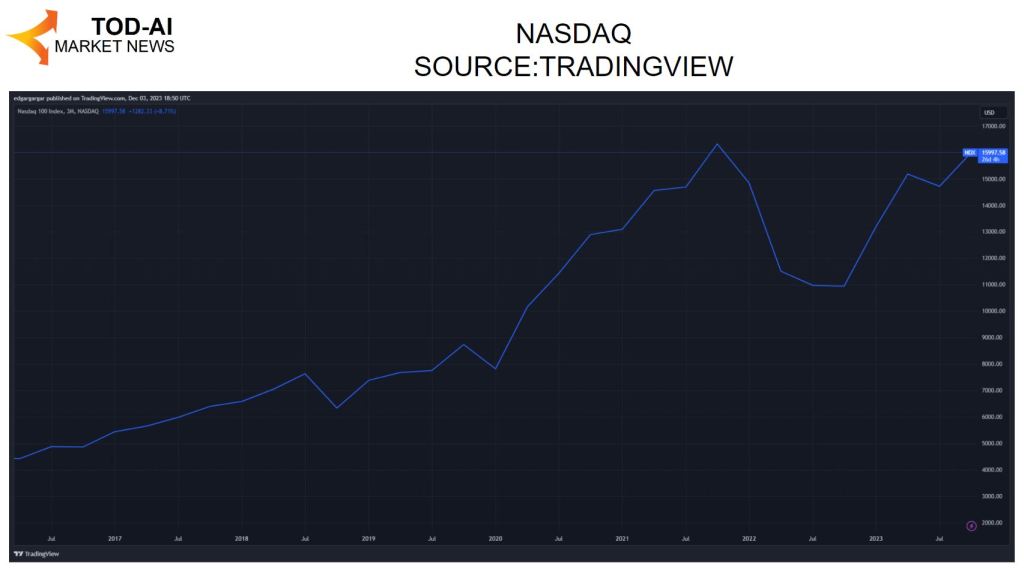

It is good at this point to remember how the NASDAQ had a great rise in the year 2000 until the «.com» bubble burst, when it fell about 70% and did not recover its value for 15 years.

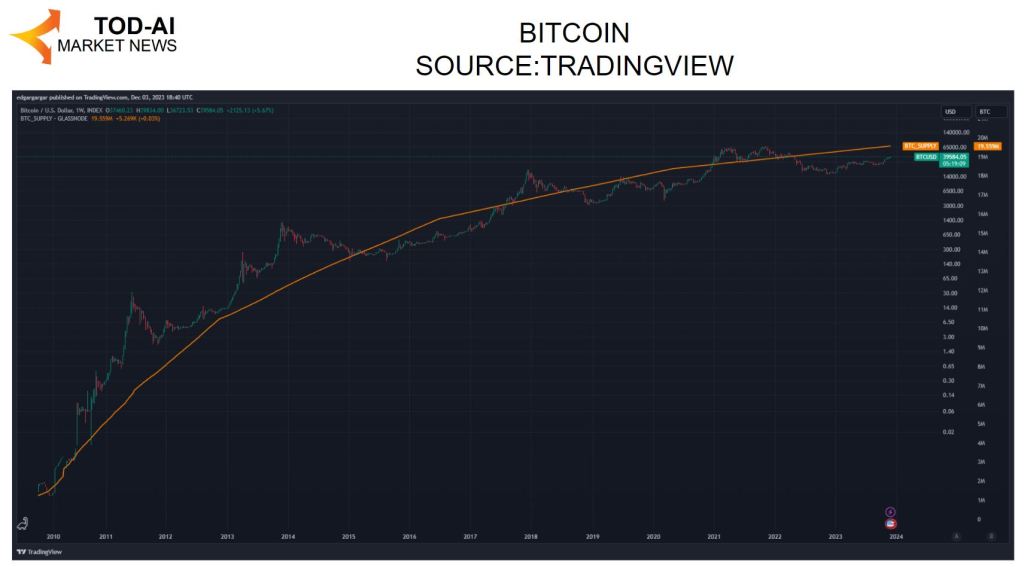

The next technological revolution after the Internet, Bitcoin, has also had its ups and downs within an uptrend, as seen in the chart.

AI was revolutionized with the appearance of ChatGPT at the end of 2022. The Nasdaq at that time was retreating, but the AI has put it at values similar to the highs it had reached.

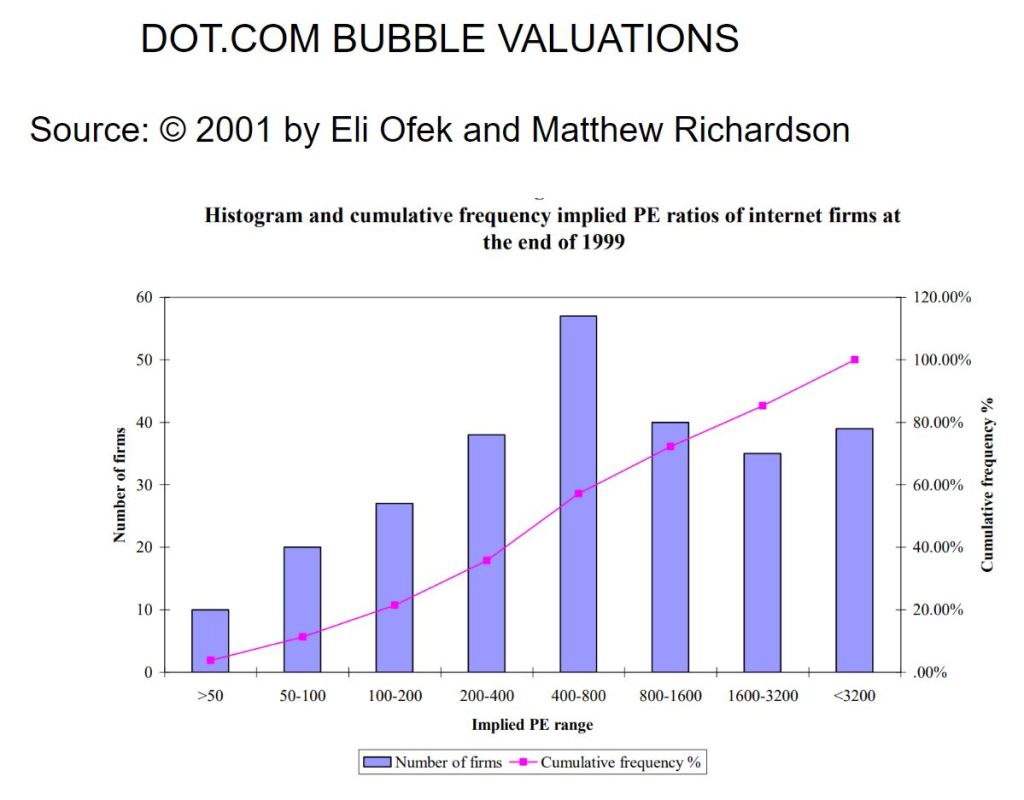

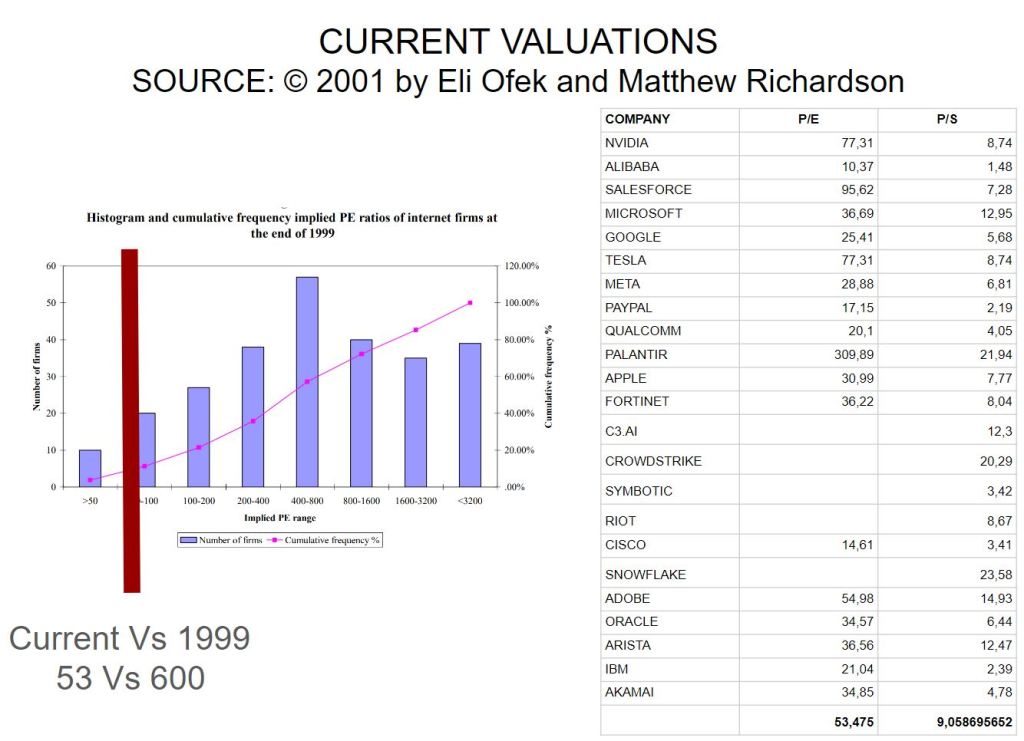

However, there are sensitive differences. The valuations of companies related to the Internet at the end of 1999 had an exaggerated valuation with respect to profits. The common average of the Price/Profit ratio of a stock is usually 20, and in the bubble «.com» reached 600 on average. We see the distribution of the number of companies by the achieved values of this ratio.

On the contrary, the valuation is currently much lower. According to a basket of companies we have taken, the average would be more than 10 times lower. The price/sales ratios are also more reasonable. These valuations can be understood as understandable for technology companies with high growth capacity.

EXCLUSIVE ANALYSIS

How do you see the AI sector from a technological point of view?

I think that the appearance of ChatGPT has led us to see the practical application of use cases that we imagined further away such as conversational capabilities, the generation of texts or content on demand, automatic computer programs and a long etcetera. I also think it doesn’t always work with great results, but it has motivated many to work with this.

From my point of view, we have to take into account that it is not as easy as it seems. The most advanced cases of AI require a lot of information and variables in the data. This involves a job in collecting them and giving them an appropriate format so that the algorithms can work on it. Additionally, it is not known at the outset which is the best analytical model to apply for your particular use case, so it is necessary to train and test several models and do it periodically. The fact of obtaining good results with AI requires all this, plus a great computational capacity that carries a cost per use and some additional security and error control mechanisms.

Although we see generalist, simple and powerful uses for the user, the technological reality is complex.

What are the risks?

We saw it in the commented cases of the Internet and Blockchain. You can be liberal or apply a specific regulation. The AI could end up performing actions of dubious morality, for example. Certain rules are going to be imposed, which will ultimately benefit large companies that will have more means to comply with them, and offer the services within the regulatory framework. We will see an oligarchy with some already known companies that come from the Internet world, and new ones.

How do you see the valuation of companies?

AI is going to be worth more than now, as it happens with the Internet and with Bitcoin. We must be attentive to this sector. Some companies may fall and others may emerge. I think that in the short term it is possible that prices will fall, because we are not entering a favorable economic environment. But I emphasize that it will be worth more.

What technological components are there that we have not discussed?

Many of the AI is developed with open source, which is not publicly traded. The community here is strong and you can’t buy it, but maybe something that is generated with it. The games and the metaverse I think are going to grow a lot. As we said, you have to be very attentive to this sector, and look for references as much as possible as has been done here.

References:

Dotcom Mania: The Rise and Fall of Internet Stock Prices https://papers.ssrn.com/sol3/papers.cfm?abstract_id=293243

Deja un comentario