In this article, I am going to analyze the charts of some of the biggest companies.

The biggest stocks in the market, from the technology sector, tops on July 2024. Now they are showing some concerning data. The weak RSI and Fibonacci retracement levels perfectly match previous support and resistance levels. There are also other concerning factors.

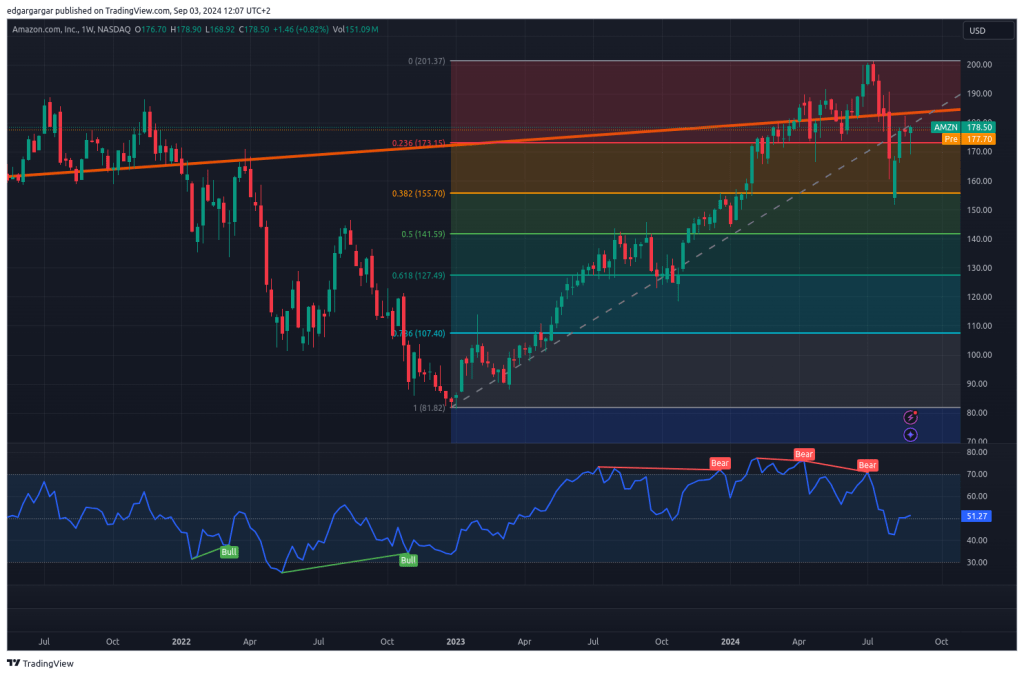

Let’s start with Amazon chart:

Source: Chart built with Tradingview tool.

Amazon shows lower levels in the RSI in the latest move-up. It is now behind the pivot line from 2022 and having resistance there in the bounce from the 0.382 Fib level.

Apple chart

Source: Chart built with Tradingview tool.

Apple is showing a weaker RSI in the last move-up. The new iphone release and AI features makes investors expect a boost on sales, but maybe it will not happen at all. A drop between 10 and 20% could happen.

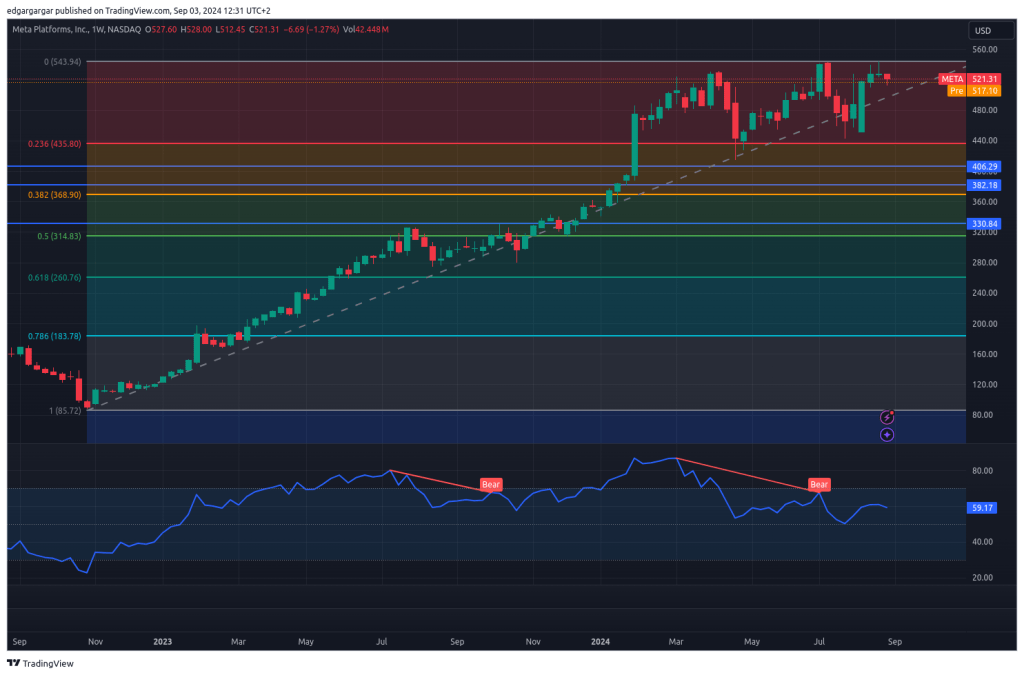

META chart

Source: Chart built with Tradingview tool.

Meta also showing RSI weakness while triple-topping. Maybe it needs to find liquidity in the 0.382 FIB level around 368$.

GOOGLE CHART

Source: Chart built with Tradingview tool.

Google is having resistance in the 0.236 FIB level and is behind the top trend line signaling a more neutral bias. Maybe it needs to find liquidity in the 0.382 FIB level around 150$.

MICROSOFT CHART

Source: Chart built with Tradingview tool.

Microsoft is showing a weak RSI in the latest move-ups. Maybe it needs to find liquidity in the 0.382 FIB level around 370$.

NVIDIA chart

Source: Chart built with Tradingview tool.

NVIDIA is showing a weak RSI in the latest move-ups. It bounced from the 0.382 FIB level, but maybe it needs to find liquidity between the pivot line and again the 0.382 FIB level, somewhere around 90$.

CONCLUSIONS

- Magnificent stocks will remain at a high valuations due to its competitiveness in the technology and AI business.

- It is time to be cautious because drops of 20% could happen.

- Demand for AI services will be strong, but expectations are also to high for the short-term.

- Maybe some drops are healthy to find stronger bounces later on.

DISCLAIMER

Invest at your own discretion. The content of this article does not provide a financial or investment advice.

Deja un comentario